MoneyWeek, which claims to be “the UK’s best-selling financial magazine” has been predicting “The End of Britain” in a slick and heavily funded advertising campaign, with the main objective of getting new readers and encouraging them to put some of their money in overseas “bolt-holes” (arguably to encourage tax avoidance as well as to guard against loss of investors’ money due to the “inevitable economic and social chaos” they predict in the UK). I wrote a critique of that video/letter on this blog in October 2013 at Is MoneyWeek’s “End of Britain” just fearmongering? What about US debt default? Is socialist revolution on the cards? Their main argument is that government debt is increasing rapidly, despite the “austerity” agenda, even when the interest rates they pay for government bonds (gilts) are around 2%, and that Britain would be “broke” and unable to pay them back if they reached a more normal level of about 5%.

[Incidentally, although “End of Britain” does not refer to the potential break-up of the country if the Scottish people vote “Yes” in the referendum later this year, Scottish National Party (SNP) leader Alex Salmond has recently remade an argument he put in May 2013 that if an independent Scotland was not allowed to share the pound that it would not pay a share of the national debt. This situation itself could exacerbate the crisis of capitalism and is in my view a major reason why virtually the entire political establishment (apart from the SNP of course) is opposed to Scottish independence. Apart from lack of control over interest rates etc., with Scotland not being truly independent if the Bank of England has power over the currency, this is another reason for the Radical Independence Campaign (which is arguing for a “Yes” vote on a much more left-wing basis to strongly argue for an independent currency.]

This blog entry is about a new web page (letter) by MoneyWeek called What Osborne didn’t tell Parliament (its web address looks temporary so do a web search for those words if that link doesn’t work). “The End of Britain” has been widely criticised because it was produced by MoneyWeek’s advertising department, and has biased graphs not adjusted for inflation or GDP, but this new letter is professional, written by financial experts and designed for serious investors. Its points are less controversial and difficult to argue against (with the propaganda against the welfare state omitted for example) although for those who believe in gradual reforms to capitalism to end up with some sort of “socialist” society, with such people often arguing that we are “the seventh richest country in the world” and that austerity is unnecessary, it is a massive wake-up call!

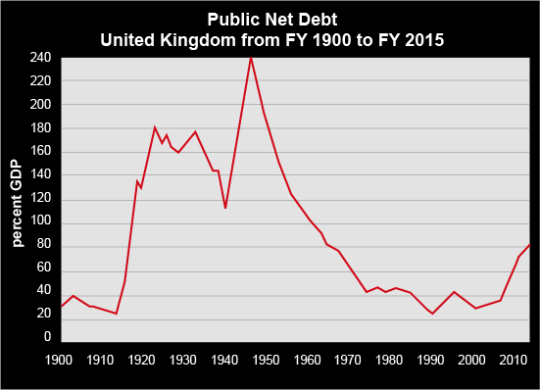

The problem with the size of the national debt is clearly illustrated with three graphs (all taken from the letter):

On the one hand, this shows that the national debt is relatively small compared to that in the aftermath of the second world war, when much of the welfare state was introduced by the incoming Labour government (that defeated Winston Churchill’s Tories who wouldn’t offer the “land fit for heroes” to the armed forces that had defeated the Nazis). However, it also shows that whereas the present ConDem government (that came to power in 2010) has reduced the deficit a little due to austerity, that is just the amount the debt is increasing by. MoneyWeek says “David Cameron’s government is going to add an estimated £530 billion to the national debt in just five years. That’s more than Tony Blair and Gordon Brown added in 11 years.”

MoneyWeek also points out that “the £900 billion it cost to pay for the mistakes of financiers [on bailing out the banks as a result of the credit crunch] who gambled with the economy and lost doesn’t count towards the national debt. That’s because government accountants choose not to include it. But when you add this vast obligation back in, the national debt spirals to £2.2 trillion (that’s £2,200,000,000,000), or 130% of our national output.”

The government’s own figures show that just paying the interest on the debt will be £70 billion a year by 2017 and even assuming the figures Osborne gave in the 2014 Budget prove to be correct, the deficit would only become negative and the debt start being reduced by the end of the next parliament (i.e. 2020), assuming of course that the next government is not overthrown by a mass movement (probably involving general strikes) and socialism introduced!

The above graph shows how the ConDems have benefited from the low interest rates they have had to pay for government bonds, compared with around 15% during the Labour governments from 1974-79 of Harold Wilson and James Callaghan, and the start of Margaret Thatcher’s Tory government. The power of the money markets to affect government policy, preventing big “Keynesian” reforms in the interest of the masses are illustrated by that graph. The “prudent” Gordon Brown, as Chancellor of the Exchequer under Tony Blair, was much more acceptable to them with “New Labour” another party of big business (much as the Republicans and Democrats are both parties of big business in the USA).

The following graph showing interest rates paid by the Greek government illustrates what can go wrong when the money markets suddenly lose confidence in a country’s ability to pay off its debts:

The letter provides three solutions for governments facing such a dilemma:

- Defaulting on the debt. MoneyWeek says “In many ways, this is the most honest and open way of dealing with debt. A country simply announces to the markets that it can’t or won’t pay all of its debts. The people who lent it money, lose out. The problem is it’s also the most damaging outcome. It often results in a wave of banking failures, bankruptcies… sometimes even civil unrest.” The breakdown of capitalist society, nationalising bankrupt banks without compensating the rich, civil unrest potentially leading to socialism – they obviously don’t want that!

- Money printing. MoneyWeek says “If a nation finds itself with unpayable debts, it has a second option. It can print new currency to pay its debts in. Of course, this runs the risk of the national currency losing its value, inflation or even hyperinflation taking off.” They give the example of hyperinflation in the Weimar Republic, due to the German government being forced to pay huge debts, largely thrust upon it as reparations for the First World War – which ultimately helped the Nazis get to power in that country. Mysteriously (but obvious to the vast majority of investors), money is indeed being effectively printed in the here and now with “quantitative easing” (QE), used by the European Central Bank (temporarily stabilising the economies of the Eurozone including Greece’s), the US Federal Reserve and the Bank of England. This massively distorts the market – in the UK, most of the QE money has been spent directly on bonds issued by the Bank of England (according to the Wikipedia QE page), keeping the interest rates it pays for such bonds artificially low, but this has still not solved the debt crisis! QE is not without its victims, of course – it is severely reducing interest rates on savings and attacking pensions, and what will happen when it ends is anyone’s guess. [The pension fund deteriorations could make Osborne’s proposal in the budget to allow people who are retiring to do what they like with their pension pot very popular – the current low level of annuities that could persist indefinitely in my opinion would greatly encourage retirees to take the money in cash, minus tax, and blow it on flash cars, cruises, etc., and then rely on the meagre state pension if they live long enough. Of course, those who don’t expect to live very long due to having lived unhealthy lifestyles or even being diagnosed with a terminal disease would be very likely to take up this option. The Tories may hope this wins them the “grey vote” at the next general election, but those already receiving a pension would be unaffected.]

- What MoneyWeek calls “Government theft“. It says “This is how 9 out 10 debt ‘crises’ play out. The government realises it does not have enough money in its coffers to pay its debt… so it forces its citizens to pay it – essentially government sponsored theft.” It talks about stealth taxes and big tax hikes, capital controls forcing people to keep money in the country, “deliberately pushing inflation up” and “rigging interest rates”. It even reveals that “according to reports in 2012, Eurozone finance chiefs have drafted proposals limiting the size of withdrawals from cash machines, border checks, and the suspension of free travel between countries.”

The upshot of all this is that the whole idea, promoted by much of the Labour left, and by reformists in more radical parties such as Left Unity, that gradual reforms can lead to socialism, is out of the question (and I personally am arguing for more radical revolutionary policies within Left Unity, a broad socialist party). Indeed, staying within the bounds of capitalism effectively means permanent austerity, which the Tories have actually argued for (and Osborne mentioned in his budget bills for “budget responsibility” and a “benefit cap” which would try to enforce that for future parliaments, although of course such bills can be repealed). That doesn’t mean we shouldn’t argue for reforms in the interest of the masses, but we should treat them more like “transitional demands” (in the Trotskyist sense) which will help lead to revolution and the rapid introduction of a very democratic socialist society!

DISCLAIMER: The above arguments are largely speculative, although I have a greater handle of the issues than when I wrote my original “End of Britain” critique – I don’t claim to be an expert on economics of either Marxist or capitalist varieties, and certainly wouldn’t recommend my advice to be used in financial speculation. However, perspectives for the British and world economy are important for socialists to discuss, and this is a contribution to this discussion. I have also set up a Facebook page “End of Britain?” – comments are welcome here or on that page.